Global economic and chemical overview

Global Economic Overview:

- In the US and Europe, inflation is easing, and central banks have ceased hiking interest rates.

- China is experiencing deflation due to weak demand for exports.

Chemical Industry Q4 Outlook:

- Chemical companies anticipate a weak Q4 due to headwinds in durables and construction.

- Dow CEO notes chemicals "bouncing around the bottom" with some positive signs, especially in US PE exports.

-Commodities Exposure:

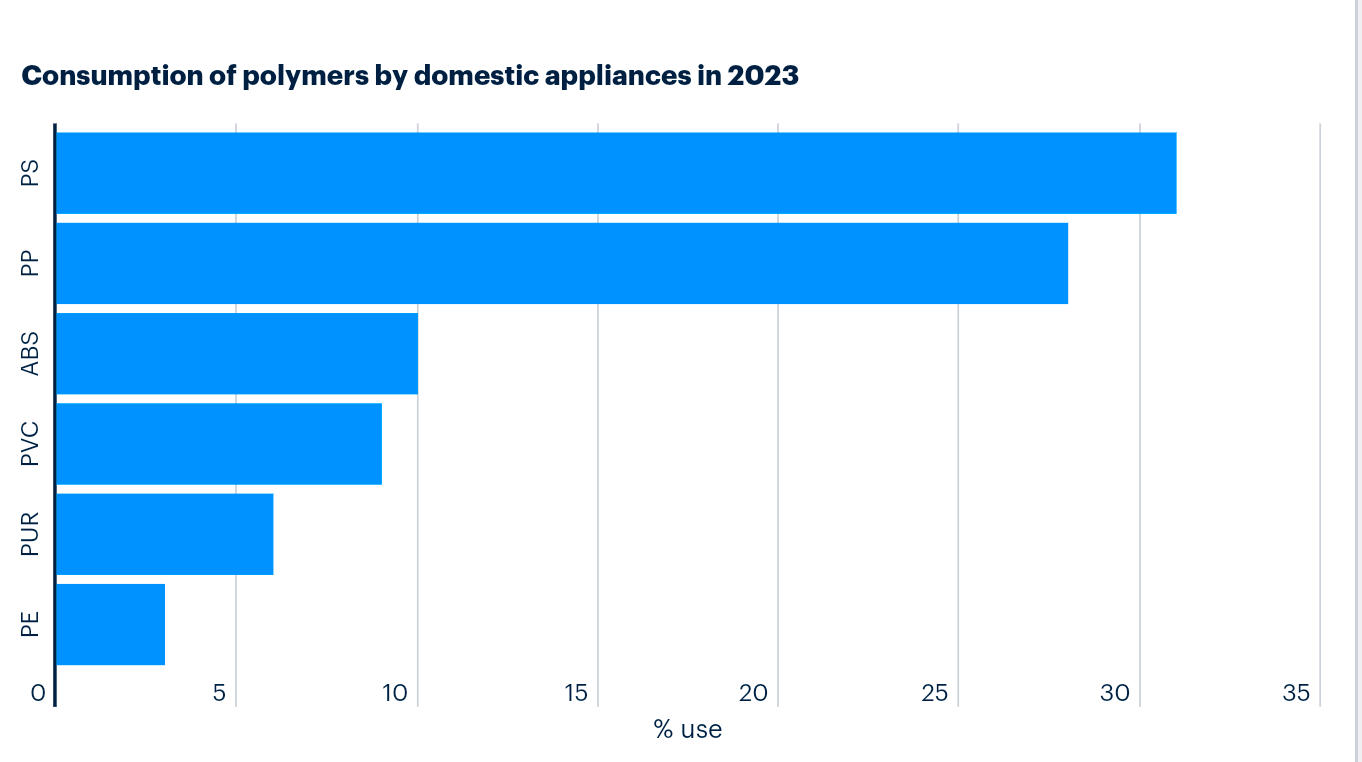

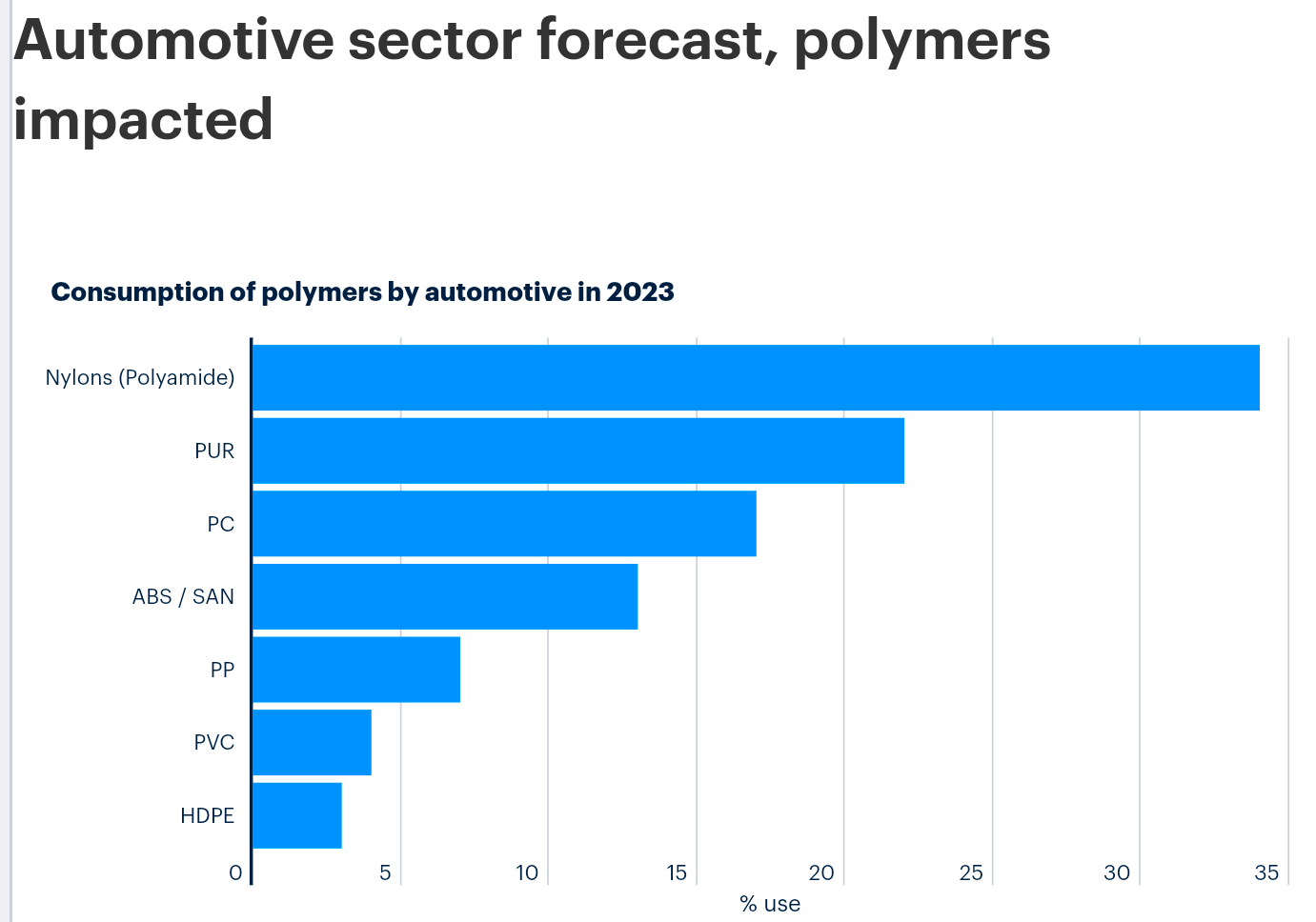

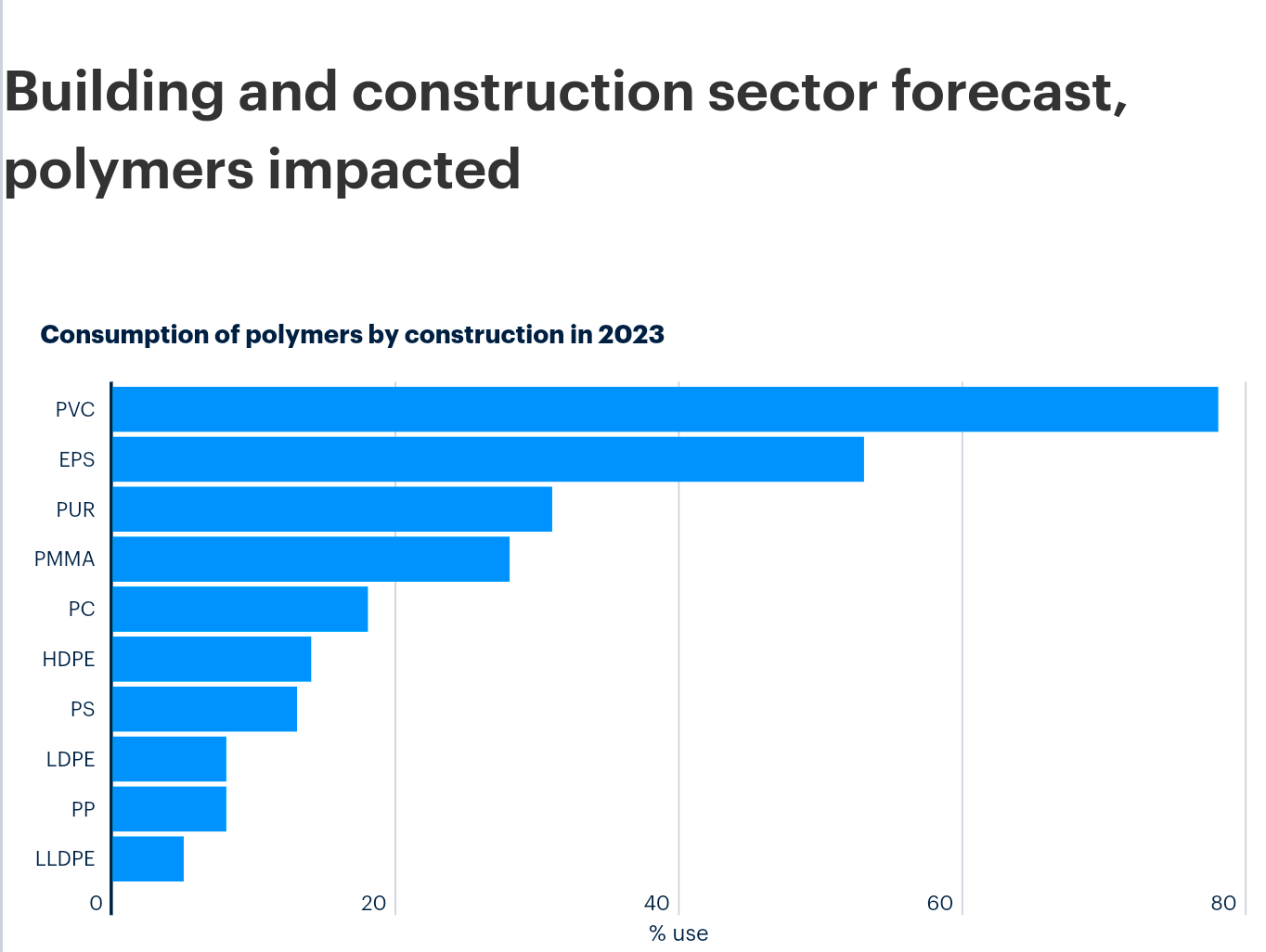

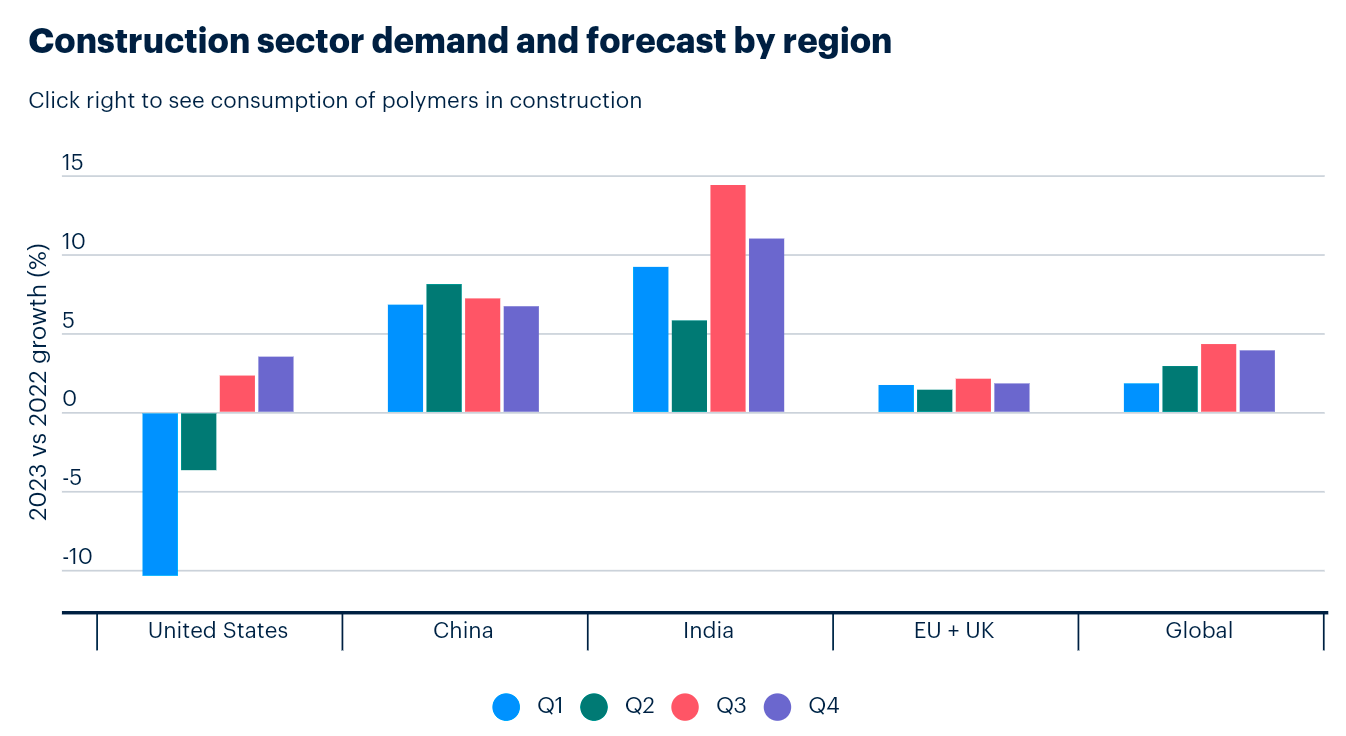

- Commodities most exposed to housing, construction, and durables include PVC, MDI, TDI, polyols, phenol, TiO2, VAM, acrylates, epoxy resins, PP, PS, ABS, PC, and PMMA.

Global Auto Demand:

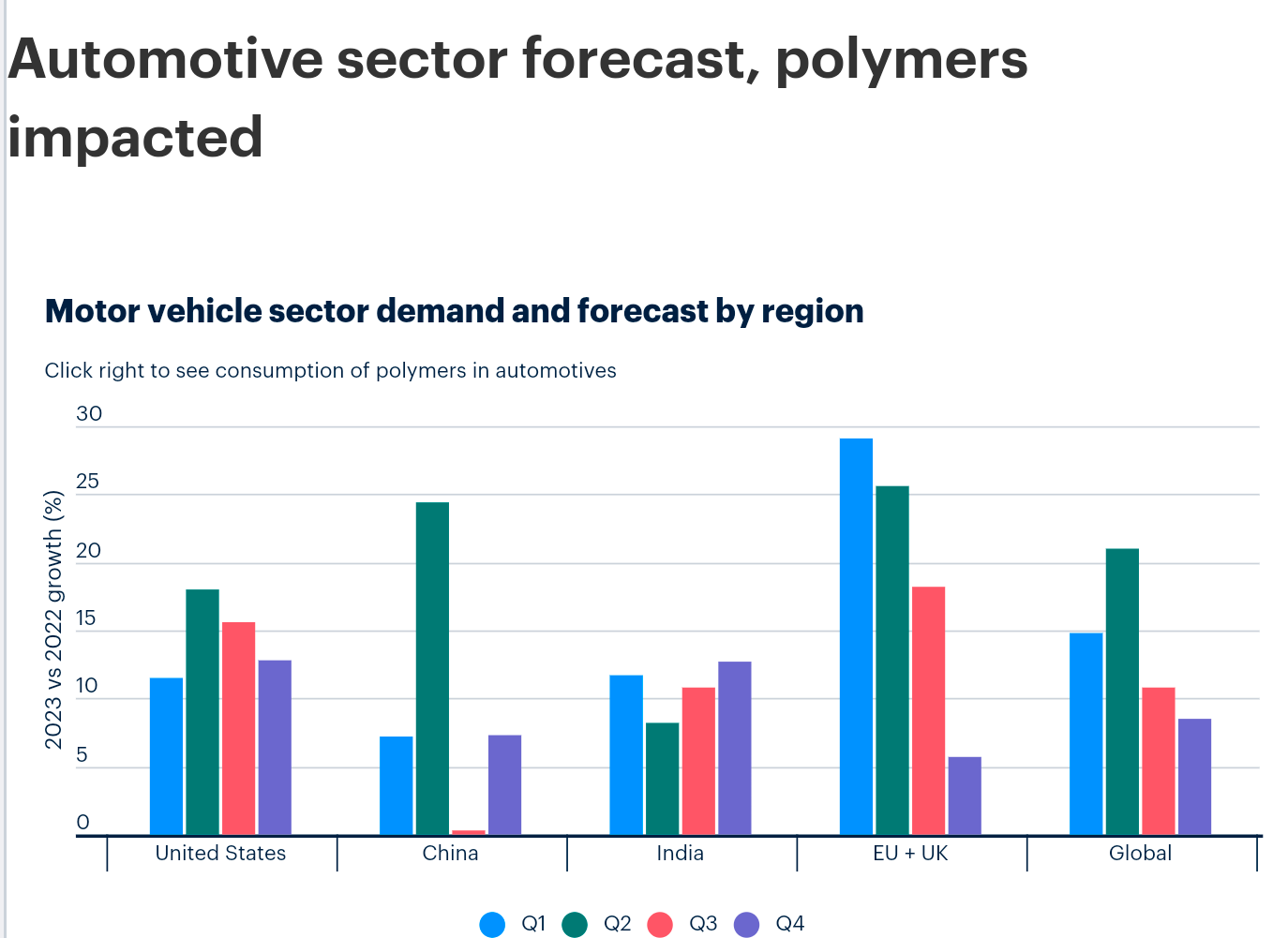

- Solid global auto demand remains a major bright spot for chemicals and plastics.

- Despite a blowout 5.2% GDP growth in Q3 2023, ICIS forecasts a weaker Q4, with US GDP bottoming in Q2 2024.

Fed's Stance and Economic Indicators:

- The Fed took a dovish stance in its December meeting, with rate hikes confirmed over, and projections of 3 rate cuts in 2024.

- 10-year Treasury yields have come off from their late October high of around 5%, indicating easing inflation and labor market tightness.

US Economic Conditions:

- Headwinds include the resumption of student loan repayments in Oct and geopolitical uncertainty with the Israel/Hamas conflict.

- Tailwinds include a still-low unemployment rate (3.7%) and massive infrastructure stimulus from bills like the IRA, CHIPS Act, and Infrastructure Investment and Jobs Act.

Global Economic Disparities:

- The US has a dual-track economy with consumer spending largely targeted to services, while chemicals' exposure to manufacturing is about 4x vs services.

- Services activity has rolled over in Europe, and manufacturing is in recession in Europe and the US.

China's Economic Indicators:

- China broke a 6-month streak of YoY export declines but experienced deflation, with consumer prices (CPI) down 0.5% in Nov and producer prices (PPI) down 3.0%.

- China's Q3 GDP surprised to the upside, and the IMF upgraded its GDP forecast for 2023 and 2024 on new stimulus measures.

Automotive Industry Trends:

- Automotive has been a bright spot for chemicals, with ICIS projecting 2024 US light vehicle sales easing slightly before rebounding strongly in 2025.

- Rising inventories of electric vehicles (EVs) are noted, averaging 89 days YTD vs 57 days for internal combustion engine (ICE) vehicles.

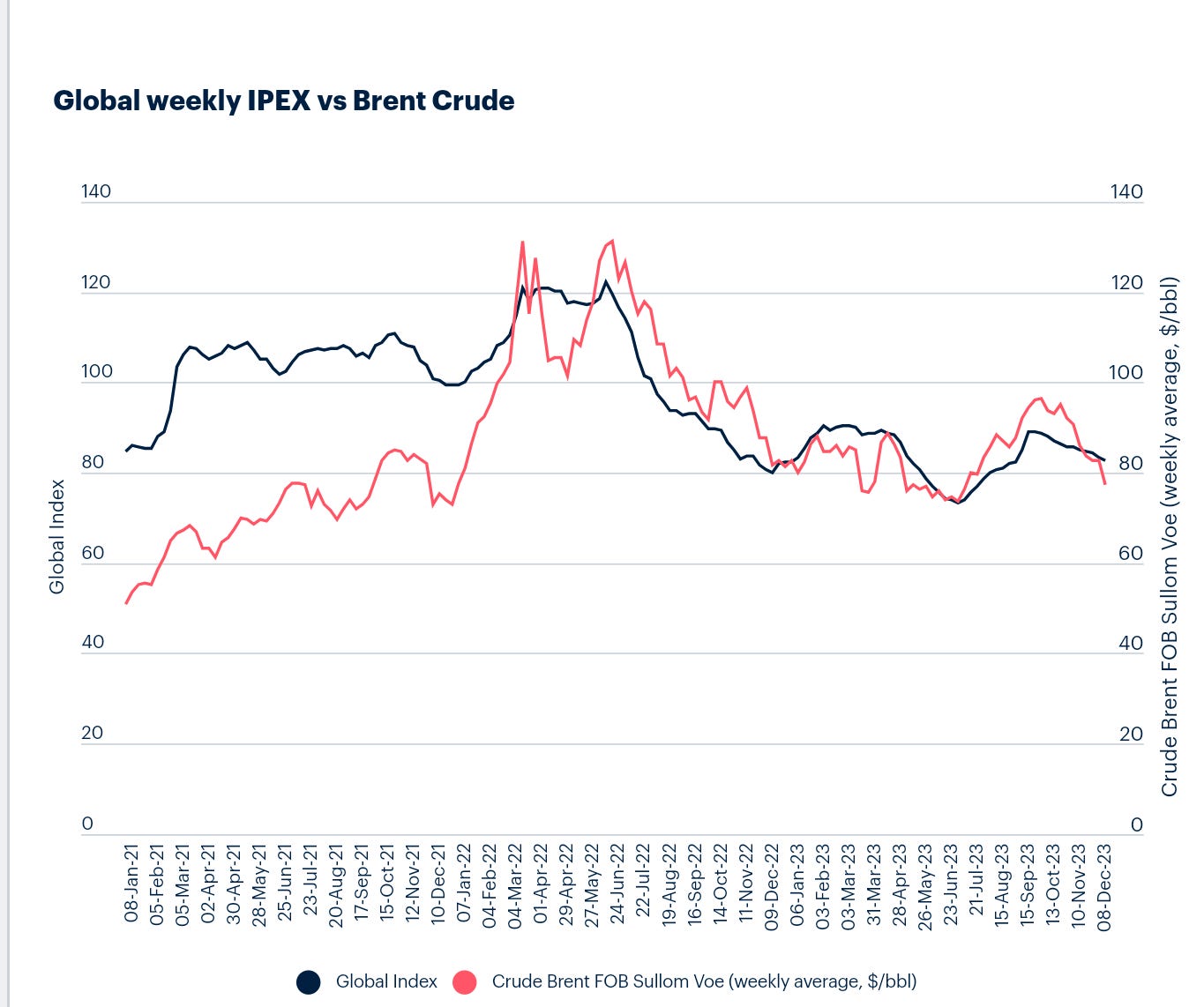

Global Chemical Prices (IPEX):

- The global spot ICIS Petrochemical Index (IPEX) declined by 0.3% week on week, marking its sixth consecutive decline.

- Northwest European index posted the sharpest fall at 1.2%, driven by softer styrene, methanol, and polyvinyl chloride (PVC) values.

- Northeast Asia's index decreased by 0.2%, with polyethylene (PE) and benzene prices rising but offset by slight falls in other markets.

- The US Gulf IPEX edged down 0.1%, influenced by demand weakness and ample supply in ethylene, styrene, and benzene.

Crude Oil Market:

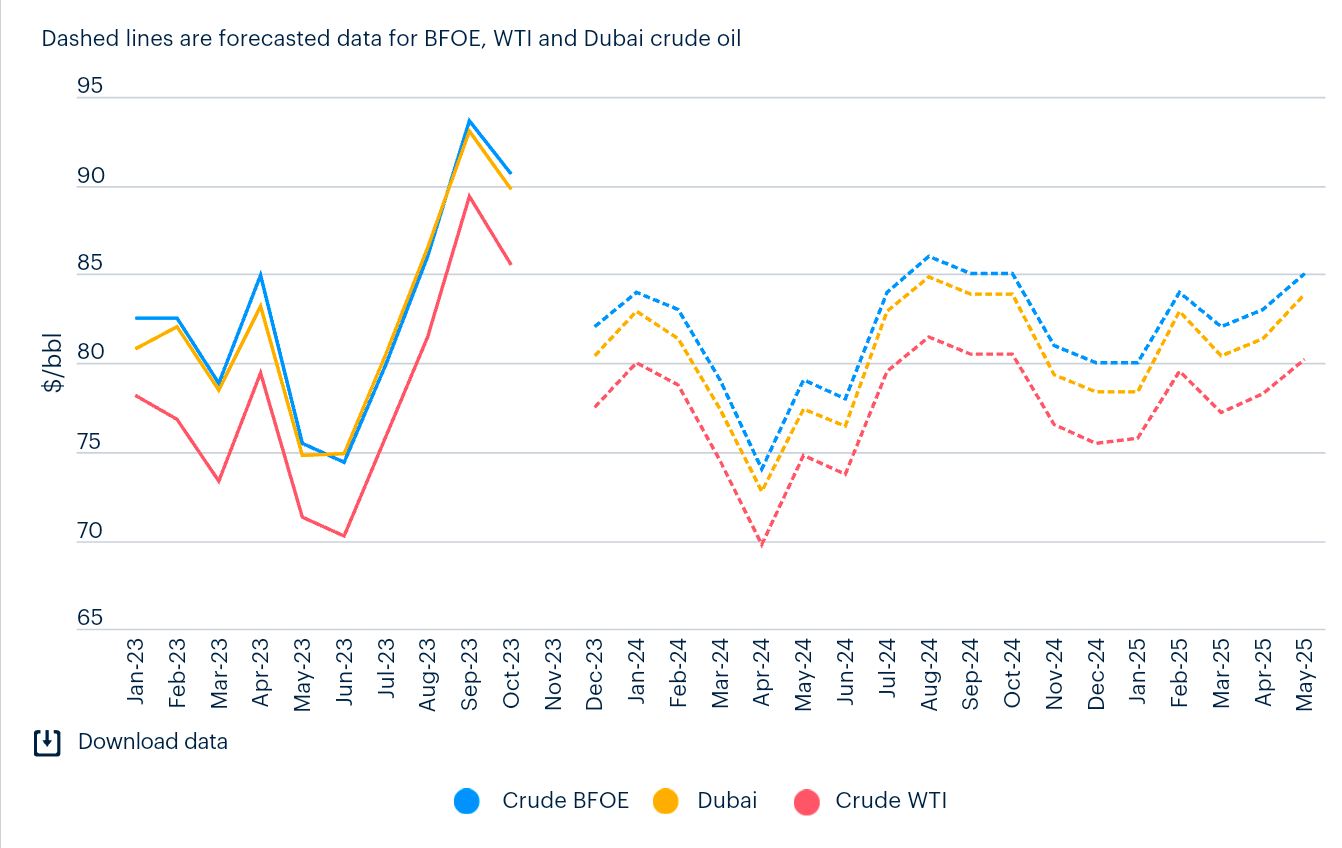

- Crude oil values rose in the week to December 15 due to tight supply worries and a larger-than-expected drawdown in US crude stocks.

- Throughout November, oil prices declined over 7% month-on-month, driven by concerns over expanding non-OPEC supply and weakening demand.

- OPEC is maintaining the current production quota, with Saudi Arabia's voluntary cut of an additional 1m bbl/d in place until year-end.

- Oil supply growth in the US and Brazil exceeded expectations in November, with limited impact from the Middle East conflict.

Oil Market Outlook:

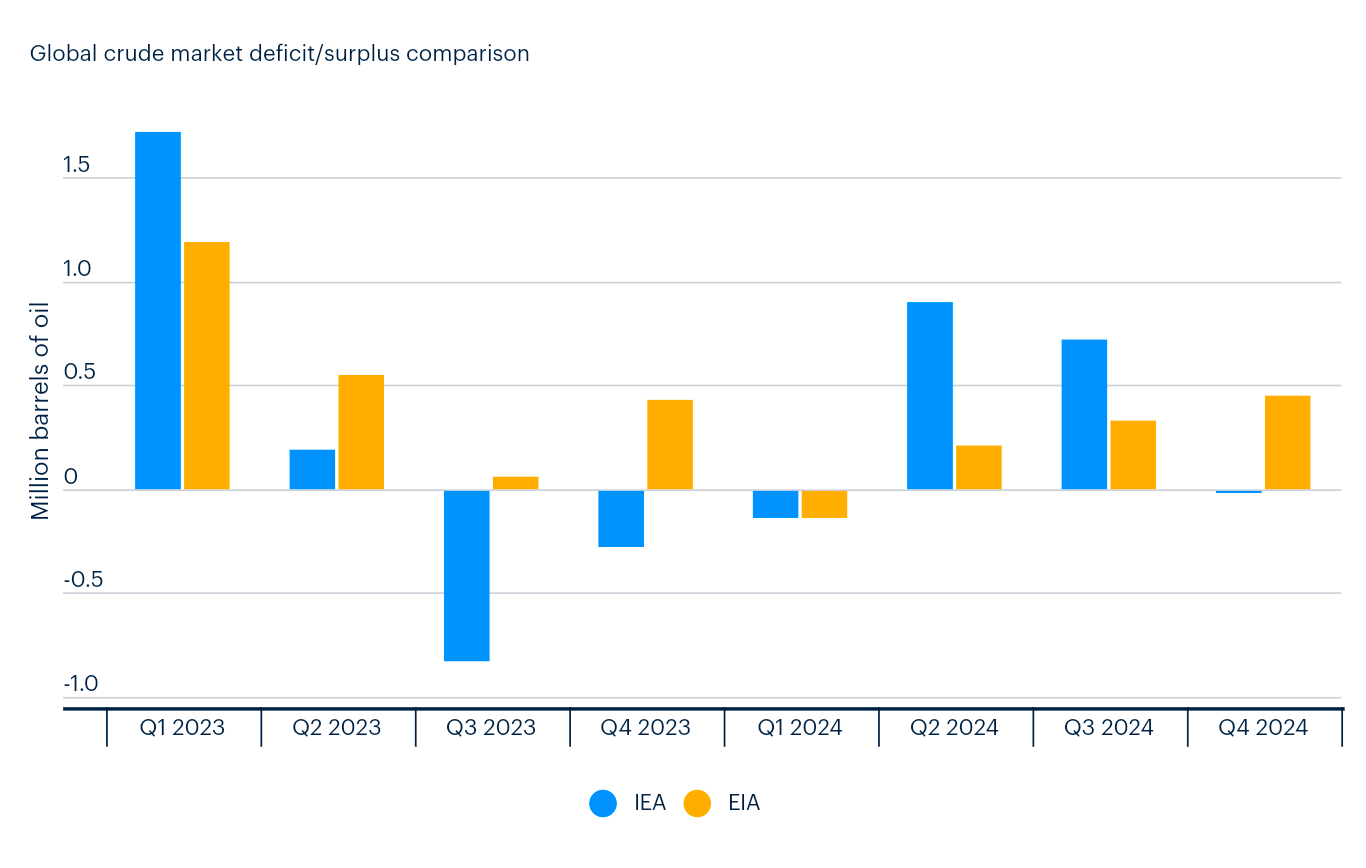

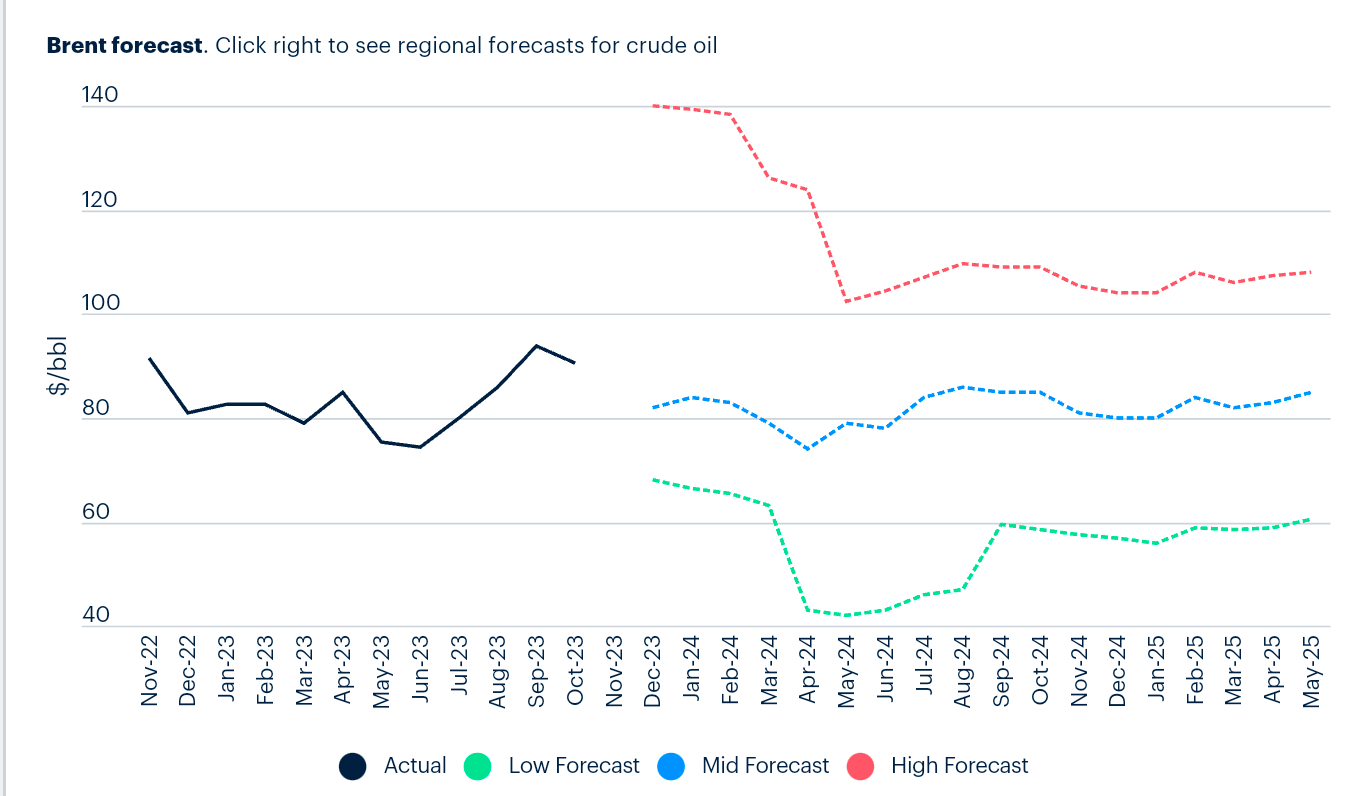

- Crude prices fell for the fifth consecutive week due to concerns of oversupply for Q1 2024.

- The US Energy Information Administration (EIA) and the International Energy Agency (IEA) forecast lower global oil consumption in 2024.

- Sentiment remains bearish, and ICE Brent and WTI benchmarks flirt with contango, indicating future oil oversupply.

- The IEA expects a crude surplus in Q1 2024, with supply growth from the US, Brazil, and Guyana offsetting OPEC+ cuts.

Economic Outlook and Industry-Specific Impacts:

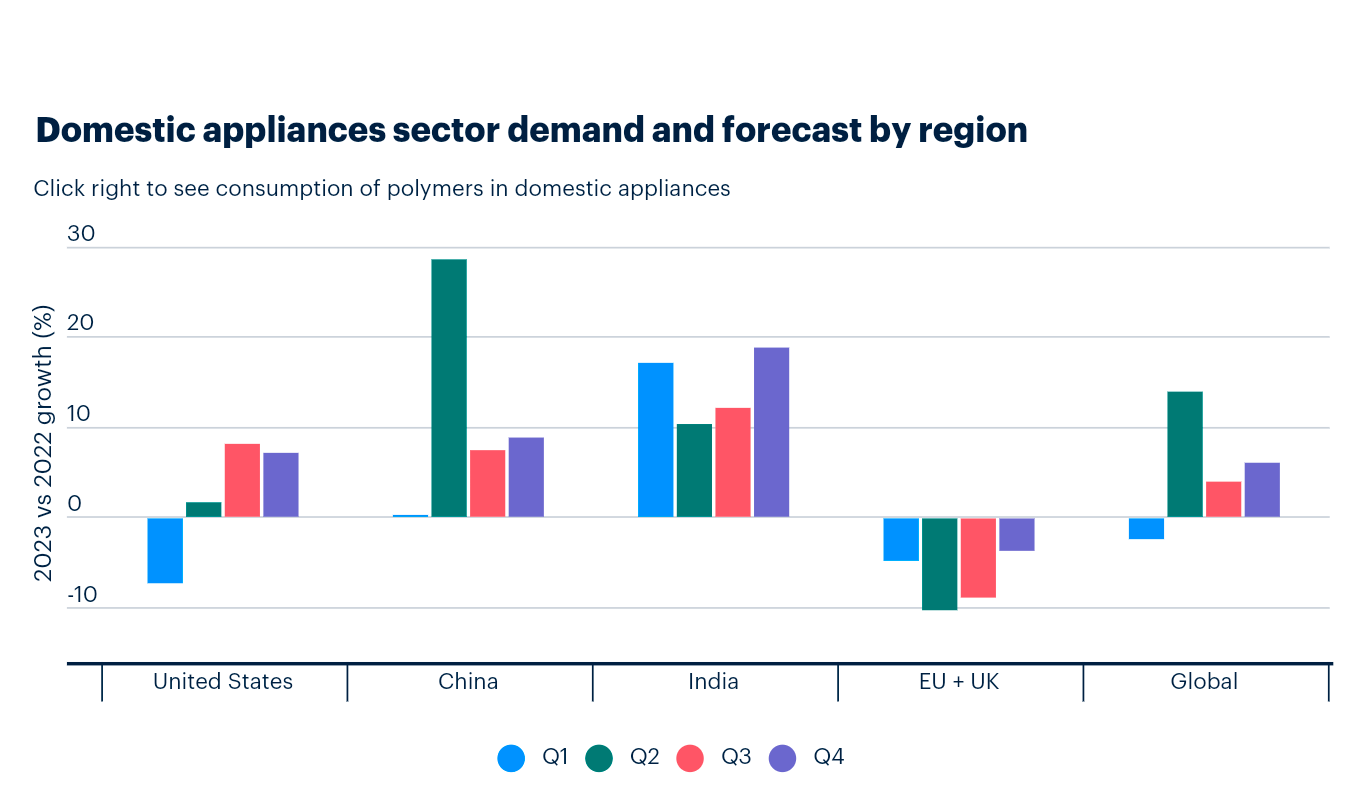

- The macroeconomic outlook for 2023 is negative, driven by inflation causing demand destruction.

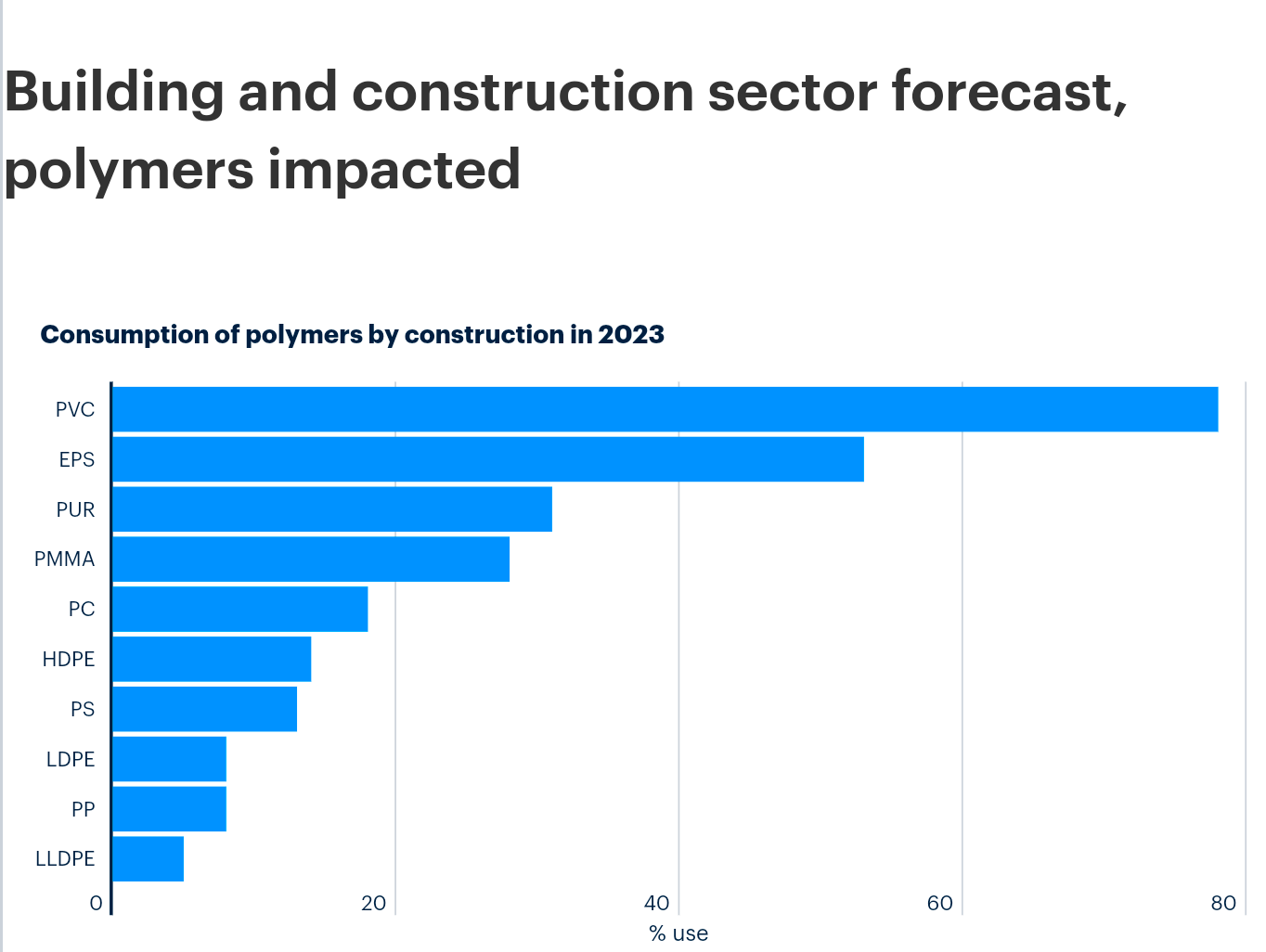

- China and India show year-on-year growth, with China's real estate woes impacting demand.

- The global auto sector outlook is positive in H2 2023, with the US light vehicle sales rebounding.

- Inflation and high-interest rates hinder the construction sector, with property developers struggling with financing.

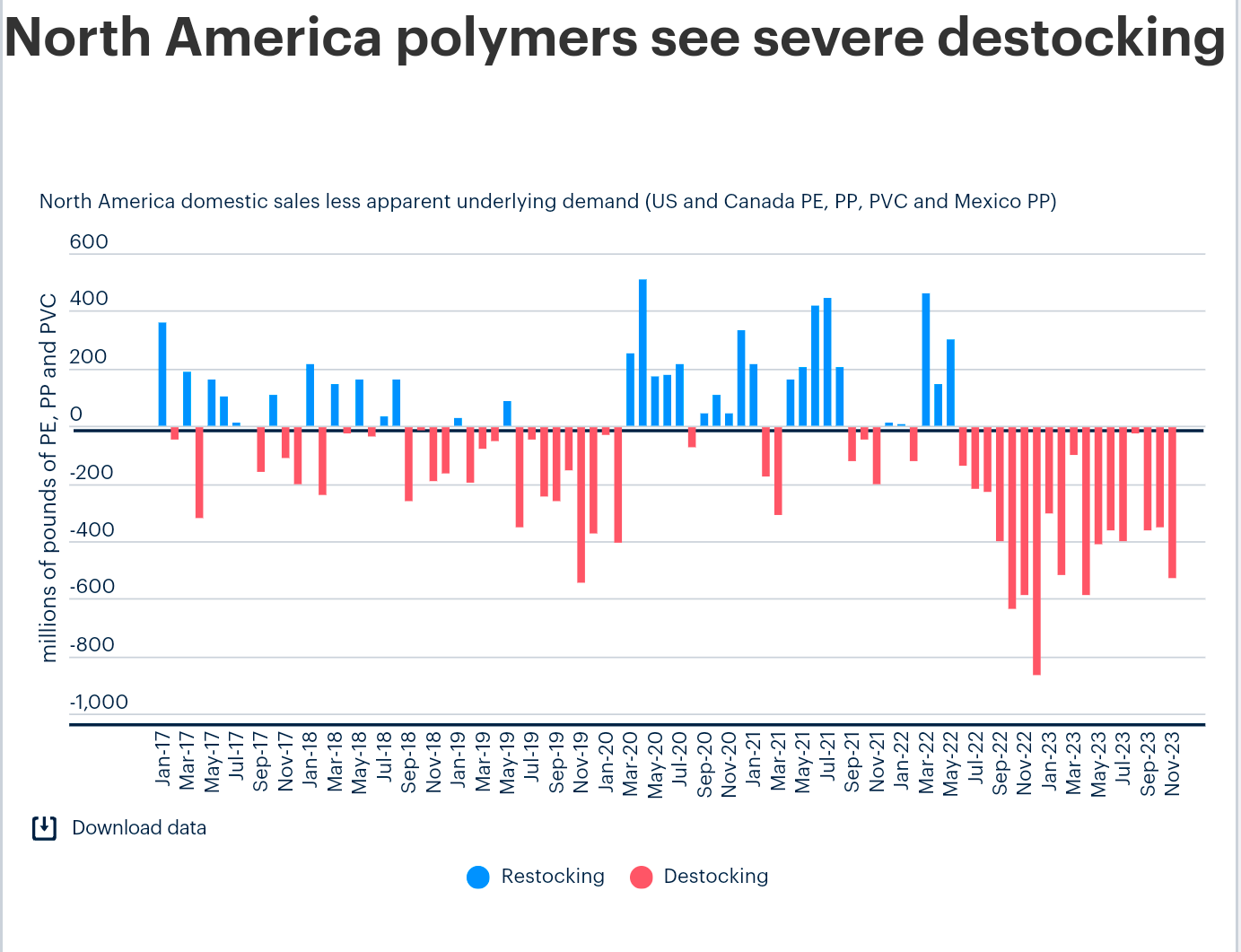

- North America's domestic sales of PE, PP, and PVC have been below underlying demand, signaling severe destocking.

- US manufacturing remains in deep contraction, Europe's manufacturing contraction improves, and China's manufacturing activity remains around the neutral level.

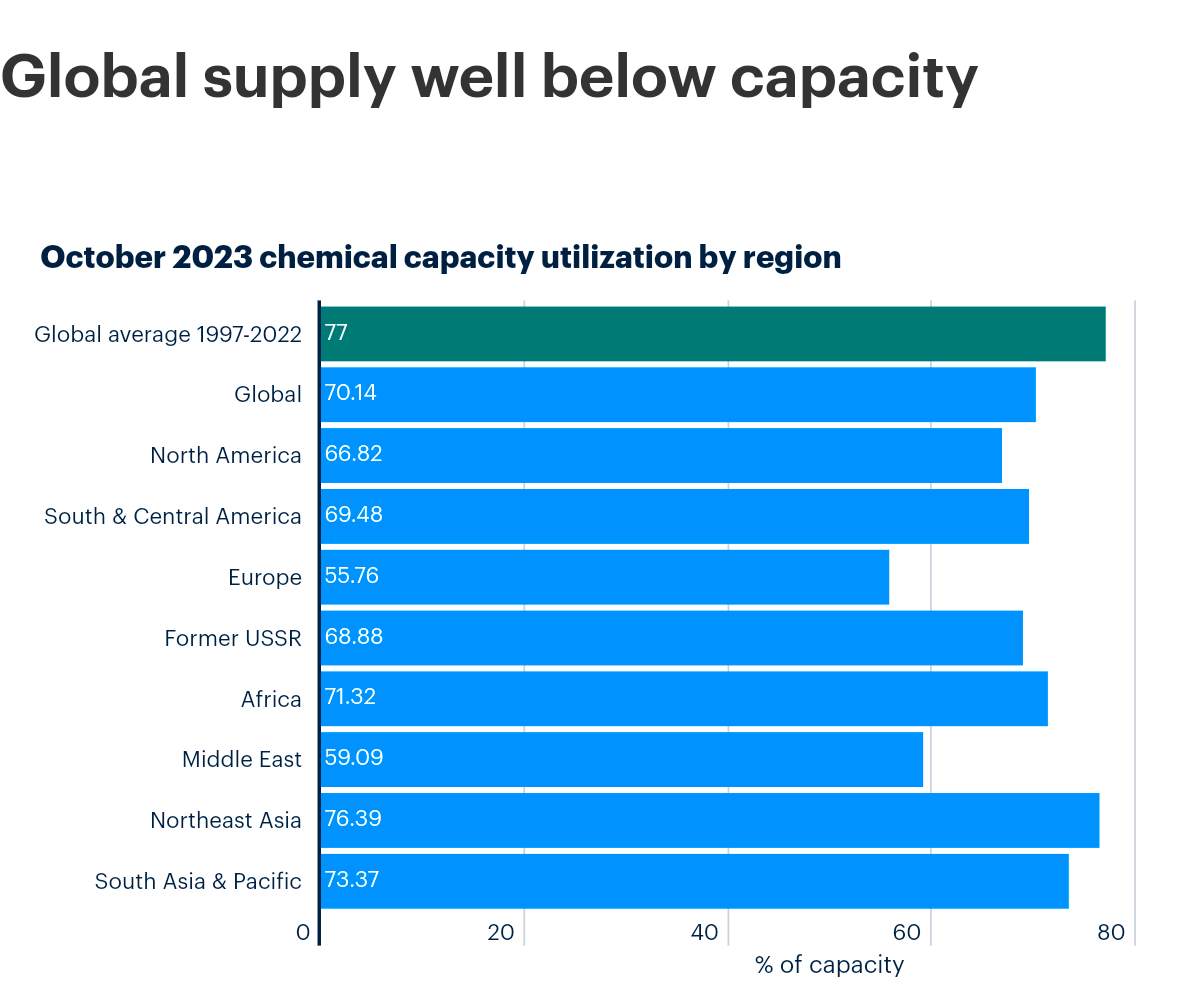

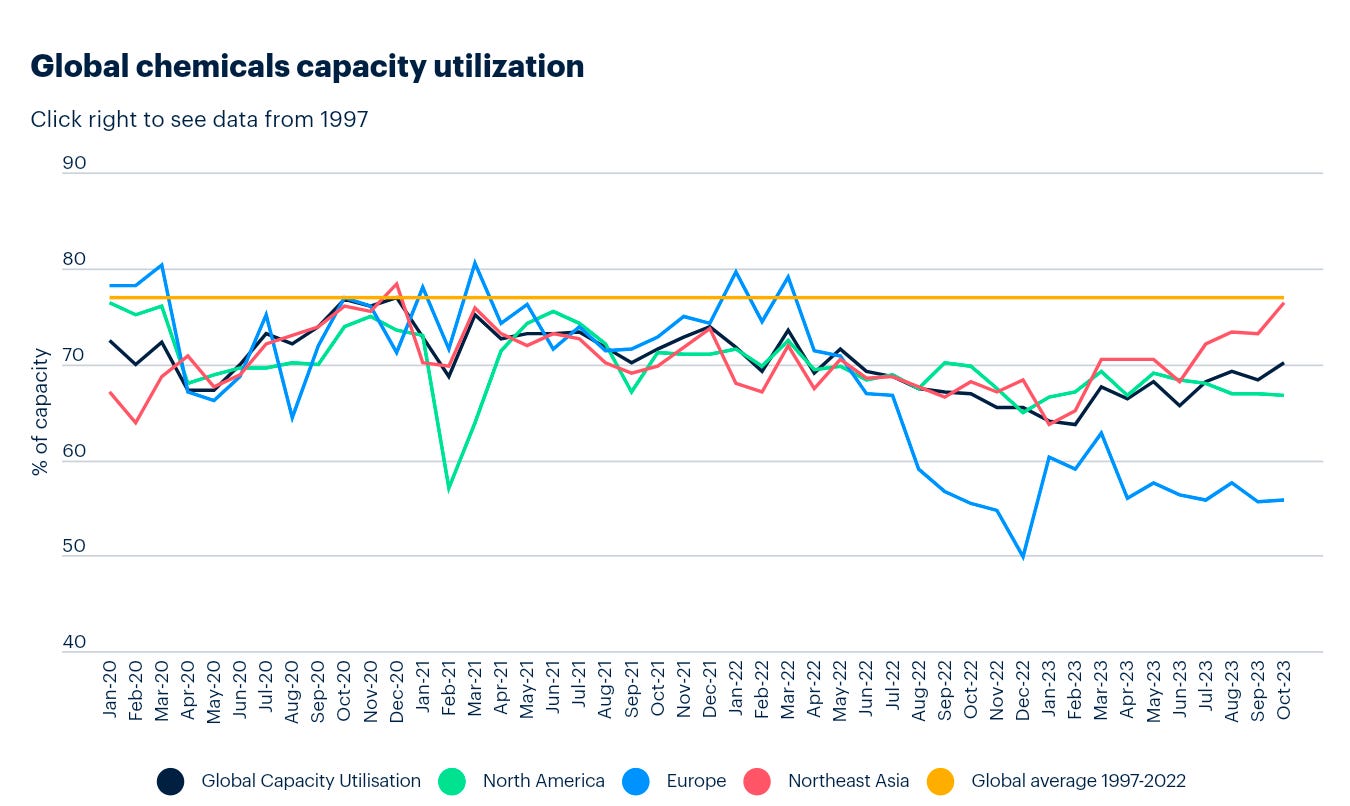

Some related graphs….